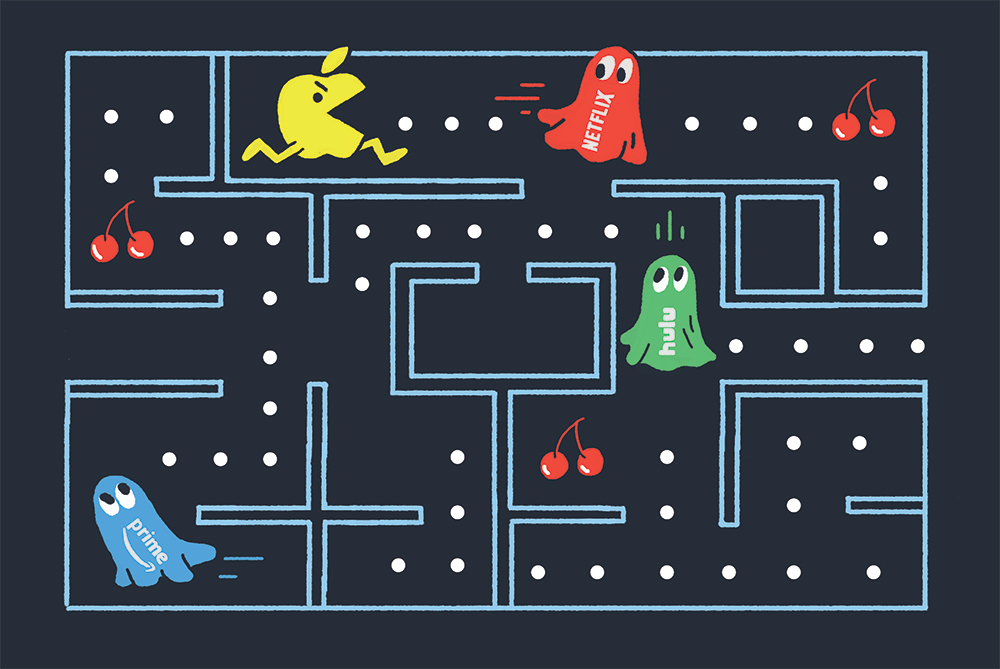

The world’s most valuable company takes its next bite

Written by JOHN ARLIDGE

Illustrations by ANDREW BECK

All eyes were on the Steve Jobs Theater in Cupertino last September for the launch of Apple’s aptly named $1,500 iPhone XS Max—but the long-term future of the world’s most valuable company was being decided 350 miles away in Culver City, near Los Angeles. It’s there that Apple is gambling on the next big thing: an attempt to dominate Hollywood and the TV industry with it.

Apple is late to the movie and TV streaming party, which has already catapulted Netflix to the gilded status of the most valuable media company in the world and helped Amazon become the second company in history (after Apple) to reach a $1 trillion valuation. So Apple boss Tim Cook has been sparing no expense to make a splashy entrance: signing a multiyear deal with Oprah Winfrey for new programs, tapping Steven Spielberg to make a 10-episode series reboot of the science-fiction fantasy show Amazing Stories, and recruiting Jennifer Aniston and Reese Witherspoon to star in a reported $12 million-an-episode drama set on a morning TV chat show. The makers of Sesame Street will create children’s programs.

Cook is ultimately in charge but has hired two top Sony Pictures Television executives, Jamie Erlicht and Zack Van Amburg, who oversaw series such as Breaking Bad and The Crown, to run his streaming business. Also on board are Charlie Day and Rob McElhenney of another Netflix favorite, FX’s It’s Always Sunny in Philadelphia, who are making a new half-hour scripted comedy series. Damien Chazelle, Oscar-winning director of La La Land, is creating a new drama. Cook is said to have approved a budget of more than $1 billion for original video content this year, rising to more than $4 billion in 2022. That’s less than Netflix and Amazon but a healthy enough start. And Apple has plenty more it could add to the pot: its cash pile totals more than $240 billion.

It might seem odd for Apple to make such a bold move just as it launches three new models of the most successful product of modern times: the iPhone. But the muted response to the new XS phones—most reviewers have urged users to wait a year for fully new models, not simply tweaked and uprated versions of last year’s X—illustrates Apple’s predicament. Revenue from laptops and iPads, but most notably iPhones, is slowing down. Between April and July, it sold 52.2 million iPhones—a meager 3 percent increase on that same period last year. Apple needs to find new income streams. That means content. The firm wants content and other services to generate $50 billion a year by 2021.

Apple has been famously late to each of the sectors it now dominates. It did not make the first desktop computer, the first smartphone, the first tablet computer or the first smartwatch. But it has become the most successful company in the history of modern capitalism by learning from the mistakes of the trailblazers and perfecting the user experience. There are signs it intends to pull off the same trick in TV.

Apple—as it likes to do—is trying something new. It doesn’t plan on selling subscriptions to its video services through a separate app, as most other streaming services do. Instead, it will sell them directly via its TV app, alongside all other content apps, including those from third parties. Currently, its TV app aggregates content from other providers but consumers have to go to each provider’s app to watch shows. Cook hopes seamless access to shows, coupled with “must watch” exclusive content, will give Apple the edge over other media players and also encourage Apple users to stick with their iPhones, iPads and Apple TV boxes, instead of switching to other devices and hardware providers.

Can it work? Apple starts with a tailwind. It already enjoys a huge audience on iTunes and Apple Music. Its commercial proposition is attractive to program makers. It does not want to own all its content, in contrast to Netflix and Amazon, which want total control, copyright and ownership.

But there are some big challenges. Apple’s attempt to break into media content creation with the Apple Music radio station, Beats 1, hasn’t really worked. Company executives claimed Beats 1 would become “the biggest radio station in the world,” but Apple hasn’t given any solid listener numbers. When Beats host and “face” Zane Lowe, who can pull in interviews with the biggest artists from Lady Gaga to Kendrick Lamar, was recently asked about ratings in an interview with the Los Angeles Times, he dodged the question.

Apple has become the most successful company in modern capitalism by learning from the mistakes of the trailblazers.

Apple had early setbacks in TV, too. The two projects it released in 2017, Planet of the Apps and Carpool Karaoke, were uninspiring. The longer Carpool format was too long for many fans used to snackable bites. It had hoped that Ryan Murphy’s new One Flew Over the Cuckoo’s Nest-inspired series, Ratched, starring Sarah Paulson as the diabolical nurse, would be among its first shows. But it was outbid by Netflix, which also recently landed producer Shonda Rhimes, whose ABC hits include Grey’s Anatomy and Scandal, in a pact reported by The New York Times to be worth $150 million over five years. It also signed Murphy,

co-creator of American Horror Story, Pose and 9-1-1, to a five-year deal estimated to be worth up to $300 million.

Cook, whose favorite TV shows are relatively tame fare (Friday Night Lights and Madame Secretary), insists Apple content cannot be too edgy. Company insiders say he is worried that a negative reaction to a series could spark a consumer boycott of Apple’s core business. As The Wall Street Journal reports: He recently vetoed what would have been the firm’s first scripted drama, Vital Signs, a dark, semibiographical tale of hip-hop artist Dr. Dre, because it featured characters taking cocaine, an extended orgy and an abundance of guns. Sex, violence and religion are out, he told Dre and his business partner Jimmy Iovine (the two co-founded the Beats headphones brand, which Apple acquired in 2014). The trouble is bold work is what newcomers need to get noticed in Hollywood, especially when they are playing catch-up. Netflix built its original-content business on House of Cards, a drama about an ethically bankrupt politician, and Orange Is the New Black, a comedic drama about a women’s prison. Both featured robust language, shocking set pieces and plenty of sex. Amazon has supported ambitious original series, such as The Romanoffs by Matthew Weiner, creator of Mad Men, and Mozart in the Jungle.

Apple has big rivals—for once, it finds itself a bit of a minnow—and they are investing heavily. Netflix, which now serves 125 million subscribers (a 25 percent increase from last year), is sinking $8 billion into content this year alone, more than twice as many as any other studio. It will make 700 original TV shows and 80 movies this year. It is also investing in more original kids’ programming and animated features.

Amazon’s Prime Video is a potentially vast up-and-coming competitor. The streaming service had a total content budget of around $4.5 billion last year, and some have speculated it will outspend Netflix by 2021. It has enjoyed top ratings with series such as Transparent, and awards-friendly features such as Manchester by the Sea and The Death of Stalin. Amazon’s boss, Jeff Bezos, the world’s richest man, worth $150 billion, has a strong incentive to outbid his rivals—and not just because he can. New Prime Video customers do not simply generate new subscription revenue for Amazon. Prime members spend more on Amazon’s core e-commerce site. Bezos has already started flashing the checkbook. He recently paid $250 million to acquire the rights to create a multiseason TV prequel to J.R.R. Tolkien’s The Lord of the Rings.

Disney, which is in the midst of its $71 billion takeover of 21st Century Fox, is pulling its top content from Netflix and other streaming services and starting its own service. The mega-studio’s ESPN+ sports streaming service has already lured 1 million subscribers since it debuted last April. Disney will soon launch its own drama-streaming network, withdrawing its films—including the Marvel Cinematic Universe—from Netflix. There are new series based on characters, likely to include Loki and Scarlet Witch, in the offing. The Marvel shows will join a slate that includes a Star Wars vehicle, created by veteran Marvel and Disney hit-maker Jon Favreau, which will be set in the time between Return of the Jedi and The Force Awakens. It is rumored to cost around $100 million, rivaling the cost of Netflix’s most lavish creation, the multi Emmy-winning drama The Crown.

Disney, which is in the midst of its $71 billion takeover of 21st Century Fox, is pulling its top content from Netflix and other streaming services and starting its own service. The mega-studio’s ESPN+ sports streaming service has already lured 1 million subscribers since it debuted last April. Disney will soon launch its own drama-streaming network, withdrawing its films—including the Marvel Cinematic Universe—from Netflix. There are new series based on characters, likely to include Loki and Scarlet Witch, in the offing. The Marvel shows will join a slate that includes a Star Wars vehicle, created by veteran Marvel and Disney hit-maker Jon Favreau, which will be set in the time between Return of the Jedi and The Force Awakens. It is rumored to cost around $100 million, rivaling the cost of Netflix’s most lavish creation, the multi Emmy-winning drama The Crown.

Spotify and Hulu, patrons of the award-winning drama The Handmaid’s Tale, have teamed up to create a rival multi-service platform. For the same subscription fee, users can access both services: Spotify’s catalog of 40 million-plus songs and Hulu’s 75,000 TV show episodes across 1,700 titles. Facebook is also softly launching Facebook Watch, an entertainment service that features stars including Bear Grylls.

Small wonder the B plot at the Emmys in September was the race to see whether HBO would keep its title as the nation’s leader in prestige television. That night Netflix beat HBO, taking home seven statuettes to HBO’s six. Amazon and FX tied for second in the broadcast with five wins each. The message was clear. The streaming studios have finally reached equal footing with their network and cable peers—and they’ve done it in a 10th of the time that the old-school big boys have been around. By the 2020 Emmys, could it be Apple knocking Netflix off the top of the tree?

Tune—sorry, sign in to find out.

This story originally appeared in the November 2018 issue of C magazine.